British psychedelic drug developer Beckley Psytech has shared topline data from a Phase 2b study of its lead candidate, intranasal 5-MeO-DMT (BPL-003), in treatment-resistant depression (TRD). The results were released this morning by way of a joint announcement with atai Life Sciences, which is set to acquire Beckley following the successful results.

The headline finding is that the short-acting psychedelic, delivered alongside psychological support, occasioned a rapid and significant antidepressant effect, with participants exposed to the highest dose (12 mg) seeing a mean MADRS decrease of 11.1 points from baseline compared to a 5.8 point reduction in the 0.3 mg comparator group at day 29. While that was the primary endpoint, the mid-dose group (8 mg) actually fared slightly better, with a mean reduction of 12.1.

Given that data, Beckley intends to move ahead with the 8 mg dose, pending discussions with FDA.

On the safety front, the company reports that the drug was “generally well-tolerated at all doses”, with no drug-related serious adverse events (SAEs), including no instances of treatment-emergent suicidal intent or behaviour in the mid- and high-dose arms.

Here, we take a closer look at the readout as well as how it stacks up against the company’s closest competitor, GH Research, which is developing the same drug for the same indication.

***

Reporting by Josh Hardman, reviewed by Medical Advisor Michael Haichin.

Pα+ Subscribers can now read an interview with Beckley Psytech CEO Cosmo Feilding-Mellen and Chief Scientific and Medical Officer Rob Conley. They can also read an update post that summarises some of the additional data and comments presented at a conference call this morning: Beckley and atai Leadership Unpack Phase 2b Data, Take Aim at GH’s Dosing Model. ∎

Results at a Glance

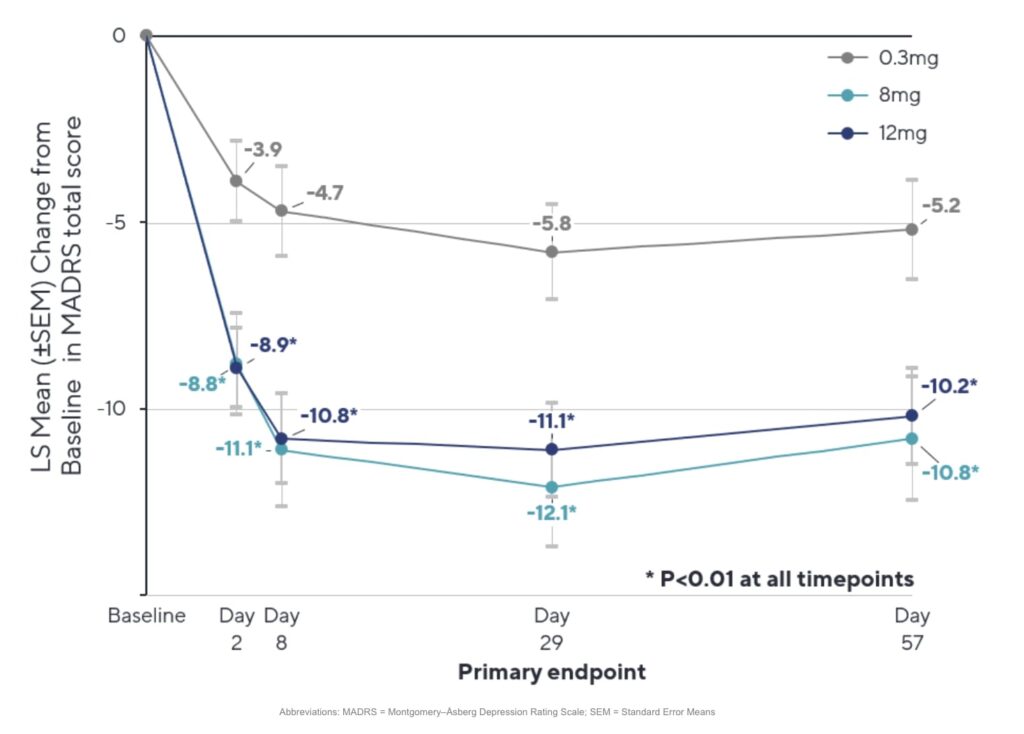

On the efficacy front, Beckley provided MADRS score changes out to day 57 (week 8):

As the figure shows, there was an immediate antidepressant effect observed at day 2 which increased substantially by day 8 and was largely maintained out to day 57 in both the mid- and high-dose arms. (Note that, while originally planned to be 1:1:1 randomisation across the three dosing arms, the study ultimately enrolled 73 patients in the low-dose, 46 in the mid-dose, and 74 in the high-dose group. For more context on that change, read our interview with company management.)

The chart also provides a look at the change in the low-dose group. At day 2, participants in that group saw a modest reduction in MADRS scores of 3.9, which increased to 5.8 at day 29 and remained somewhat stable at 5.2 at day 57.

This is an impressive difference between both the 8 and 12 mg groups and the 0.3 mg group that is both rapid and sustained to day 57.

Turning to safety, the company reports that the drug was generally well-tolerated at all doses, with no drug-related serious adverse events (SAEs). The company added that dose-related increases in the incidence of adverse events like administration site discomfort, nausea, headache, blood pressure, and anxiety suggest the 8 mg dose was better tolerated by patients.

This is surely a relief for Beckley and its backers, as its closest competition, GH Research, had earlier reported no SAEs in its own Phase 2b study (more on that below).

But many practitioners who have worked with 5-MeO-DMT emphasise that even an eight-week follow-up may not be sufficient to fully understand the safety profile of the potent psychedelic, with distressing symptoms like ontological shock sometimes occurring several months after the experience itself.

Beckley’s Topline vs. GH Research’s

As aforementioned, Beckley is not the only drug developer going after this drug-indication pairing.

While cross-trial comparisons are dicey, especially given the substantial trial design differences discussed later in this section, many will be looking at Beckley’s results side-by-side with GH’s, given just how competitive the pair are.

In February, GH reported positive Phase 2b results from its own study (see GH Research Reports Strong Phase 2b Results for 5-MeO-DMT in Treatment-Resistant Depression).

The headline finding was a whopping placebo-adjusted MADRS reduction of -15.5 at day 8, with 57.5% of those exposed to the drug in remission at day 8 vs 0% in the placebo group. The company also reported a clean sweep across secondary endpoints (CGI-S, HAM-A, Q-LES-Q-SF).

What’s more, GH said that its inhaled formulation of the short-acting drug was well-tolerated, with no SAEs.

The enormous placebo-subtracted MADRS delta might have been boosted by an apparent nocebo effect, with those in the placebo group seeing slight worsening of depression symptoms (+0.3 MADRS at day 8).

Still, even discounting for that fact, the results were positive and welcomed by the market, with the company’s public valuation briefly surpassing $1bn once more.

Trial Design Comparison

Looking at the two Phase 2b trials side-by-side, we might first notice that GH’s MADRS reduction at day 8 was greater than Beckley’s, with a -15.2 point decrease versus -10.8 (12 mg) and -11.1 (8 mg) in Beckley’s study.

However, as alluded to, there are major differences in the design of the two Phase 2b studies. These are crucial to consider when comparing results. See the table below for a summary of key trial design features:

One of the more striking differences between the two studies is their size. With an enrollment of 193, Beckley’s study is more than twice as large as GH’s. It is generally the case that effect sizes decrease as trial sample sizes increase.

Another glaring difference is the primary endpoint. At day 8, GH’s is rapid, with no other released data to indicate durability. That means that it’s difficult to compare the drug even to other rapid-acting drugs like Spravato.

Beckley’s day 29 primary endpoint, meanwhile, offers an early look at durability, demonstrating that the antidepressant effect is robust after about a month and sustained out to day 57, when the study was unblinded.

Other study design features might explain GH’s greater MADRS delta. Take, for example, the fact that GH was trialling its GH001 candidate against an inert placebo.

When coupled with the company’s IDR protocol, which sees patients asked after each dose of placebo or 5-MeO-DMT about their subjective experience and if they achieved an intense psychoactive effect to determine if another dose (ascending, in the GH001 arm) is warranted, this could have driven a nocebo response by making it oh-so-clear to a patient in the placebo group that they were not assigned to the active arm.

What’s more, those in the active group were eligible to receive up to three doses (6, 12, and 18 mg)1, thus increasing the odds of an antidepressant response. Beckley’s protocol, meanwhile, sees a single low, medium, or high dose administered to patients. While the open-label extension period will see that monophasic dosing compared to a biphasic model (where participants are given 2 nasal sprays, 4 mg and 8 mg, approximately 10 minutes apart), the blinded portion that today’s readout did not employ such a strategy.

In terms of trial geographies, Beckley execs have emphasised the fact that its study is the “first and only blinded Phase II trial in the US” of 5-MeO-DMT, which also has various European sites. Those include sites in the UK, where GH was unable to get its sites launched due to “significant delays in control drug licenses and bureaucracy”, CEO Velichka Valcheva told us at the time.

GH’s study was entirely European, with 11 sites across 6 countries. In an odd move, which we noted in earlier coverage, the company—which has a reputation for secrecy—did not disclose the names of the trial sites it used.

While the pair’s non-drug protocols are not entirely clear, Beckley’s trial registry entry mentions the fact that the drug is delivered alongside ‘psychological support’ a dozen or so times. In its Phase 2a study, the company provided psychological support during preparation, dosing, and integration sessions.

GH’s trial registry entry, meanwhile, makes no such reference, with the company appearing to pitch the drug as a standalone intervention. In presenting its Phase 2b results, it said that the trial “is conducted under the supervision of a healthcare provider, but without any planned psychotherapeutic interventions before, during, or after dosing.” (We covered this in greater detail at the time.)

But Beckley execs told Psychedelic Alpha that they do not believe there are major differences between the type of psychological support they provide and that was provided in GH’s Phase 2b trial. Read our interview with Beckley’s CEO and CMO for more.

Now, consider how all of these trial design factors might have figured into the placebo (or, low-dose) response rates seen in the two studies. GH’s smaller Phase 2b printed a very modest reduction in the inert placebo arm at day 2 (-1.5) and a mild nocebo response (+0.3) at day 8.

As aforementioned, meanwhile, Beckley’s low-dose arm printed modest reductions in MADRS scores at all time-points, including -5.8 at the primary endpoint, day 29.

It’s also interesting to look at the time-course of the effect across the two studies. In GH’s case, its active arm saw a reduction of -17.8 2 hours after dosing, -18.6 at day 2, and -15.2 at day 8, showing a slight attenuation or ‘bounce’. Beckley, meanwhile, saw (in its 12 mg group) -8.9 at day 2, which increased to -10.8 at day 8. In that interview with Psychedelic Alpha, Beckley execs speculated on why this might have happened as well as much, much more.

So, while the two readouts will inevitably be compared to one another, readers should keep these substantive differences in mind when doing so.

Article continues below advertisement…

The TRD Armamentarium

Today’s results from Beckley are certainly impressive, both when compared—however treacherously—to its closest rival GH Research’s, but also when viewed in the context of products that are already on the market or under development.

Now, we should expect to see both GH’s and Beckley’s effect sizes tempered over time as the candidates are trialled in larger studies, but they’re both working with an impressive mid-stage dataset here. Given Beckley’s much larger N, some might place more confidence in its results and potentially expect less of a dip in Phase 3.

A Phase 3 study of Spravato, which both companies are using as the primary comp for their 5-MeO-DMT candidates, found a -4.0 difference between the active group and the placebo at day 28 (Popova, 2019, though note that participants were also using an antidepressant during the trial), meanwhile, and -6.8 in its recent Phase 4 monotherapy study.

On the psychedelics front, Compass Pathways’ Phase 2b trial of psilocybin in TRD, which also had a three-arm design, reported a very similar -6.6 MADRS difference from baseline to week 3 between the 25mg and 1mg groups (Goodwin et al., 2022). In its recent Phase 3 readout, where the drug was compared to placebo, it reported a lower MADRS difference of -3.6 at week 6.

So, despite all the usual caveats, Beckley’s data does appear impressive when compared to both its closest competitor but also the TRD armamentarium and pipeline more broadly.

BPL-003’s Commercial Positioning

Given that both GH and Beckley are pitching their 5-MeO-DMT formulations as Spravato competitors, they’re hoping that their respective candidates will demonstrate a more durable antidepressant effect within the same 2-hour window as the esketamine nasal spray. Indeed, in this latest cut of data, Beckley emphasises that the majority of patients were deemed ready for discharge at the 90 minute post-dose assessment mark.

If that is borne out in Phase 3, the companies could offer a product that allows TRD patients to experience substantial symptom reduction with only a handful of visits per year, versus the dozens regularly seen in the case of Spravato.

Comparing the two candidates from a drug delivery standpoint, Beckley’s intranasal formulation might presently have an edge over GH’s inhaled version which saw, in its Phase 2b, patients inhale the drug using a commercially available Volcano device, which is an authorised medical device often used for medical cannabis. GH is working to pivot to a proprietary inhalation device, and recently submitted a response to an FDA clinical hold that sought, among other things, further specifications regarding that device.

A glaring concern for both companies, however, is the intellectual property landscape. Given both companies are pursuing such similar goals, it’s unsurprising that the pair have filed overlapping patent applications over the past years.

As we detailed in our February 2024 Patent Analysis, ‘A Mebufotenin Melee’, it appears that this pursuit of overlapping IP may have moved beyond the mutual filing and prosecution of each company’s respective patent portfolios, and, potentially, towards more formal oppositions.

Indeed, in a January 2024 filing from atai Life Sciences, the company revealed an “ongoing patent dispute” between Beckley Psytech and GH Research, in connection with a significant European patent owned by the latter competitor.

While GH Research, for the time being, appears to possess a strong competitive advantage in the European market owing to its patent portfolio, as we will share in a forthcoming analysis, that advantage is now being challenged through formal opposition proceedings led by psychedelic patent watchdog Porta Sophia and a second anonymous opponent.

Despite this lack of IP clarity, the results of this trial were promising enough to satisfy the success criteria needed for atai and Beckley to move forward with their previously announced combination, which the company now expects will advance to shareholder approval.

Pα: This is a stellar readout from Beckley Psytech, which had to deliver on both safety and efficacy in order to stay relevant in the shadow of its publicly-traded competition, GH Research, which released its own positive Phase 2b results earlier this year.

In spite of a slightly lower headline MADRS score reduction than GH’s, the much larger sample size, its day 29 primary endpoint (versus day 8), and its use of U.S. sites might lead some to view Beckley’s results as just as impressive, all with room to be tempered in Phase 3 while retaining commercial and clinical relevance. In an interview with Psychedelic Alpha, Beckley CEO Cosmo Feilding-Mellen said that he believes an additional dose will increase the antidepressant effect further.

It is also important to be mindful of other methodological differences between the pair of studies, including Beckley’s three-arm design that sees a low-dose comparator used instead of an inert placebo, as in GH’s. Beckley also opts for an intranasal formulation delivered monophasically (versus GH’s inhaled individualised dosing regimen).

Despite differing designs and data, both Beckley and GH’s results are directionally similar, demonstrating significant and rapid-acting antidepressant effects. In Beckley’s case, there is also a promising durability signal.

Now that it has delivered the data, a planned merger between atai Life Sciences and Beckley is set to go ahead, meaning this might be one of the last things we write before referring to the new entity, atai Beckley. (See atai Moves to Acquire Beckley, If Phase 2b 5-MeO-DMT Data Delivers.)

The race to approval of a 5-MeO-DMT product really is on, with both Beckley and GH plotting to launch Phase 3 programs in pursuit of FDA approval. GH’s plans on that front have been delayed due to FDA slapping a clinical hold on its Investigational New Drug (IND) application in the country, but it recently announced the submission of a complete response to that hold. It should expect to hear back from the agency in the coming weeks.

Being the first to approval confers all sorts of benefits to a drug developer, not least market and data exclusivity. But the most attractive form of exclusivity remains to be the time-limited monopoly that comes with patents, and that situation is very unclear when it comes to these two dueling 5-MeO-DMT developers. We covered the sticky IP situation back in February 2024 (see A Mebufotenin Melee) and will soon be publishing an update.

Still, today offers a moment for Beckley Psytech to celebrate its readout and catch its breath as it embarks on the enormous task of launching pivotal trials. ∎